mississippi income tax rate

Mississippi is one of just a few states to apply sales taxes to groceries. Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut.

Mississippi Who Pays 6th Edition Itep

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. We dont make judgments or prescribe specific policies. The Mississippi tax tables here contain the various elements that are used in the Mississippi Tax.

For more information about the income tax in these states visit the Mississippi and Alabama income tax pages. Mississippis tax system ranks 30th overall on our 2022 State Business Tax Climate Index. If youre married filing taxes jointly theres a.

Any income over 10000 would be taxes at the highest rate of 5. The Mississippi income tax accounts for 34 of state revenue. Your 2021 Tax Bracket To See Whats Been Adjusted.

There is no tax schedule for Mississippi income taxes. Discover Helpful Information And Resources On Taxes From AARP. The Mississippi Single filing status tax brackets are shown in the table below.

Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Give Mississippi when fully implemented the fifth-lowest marginal tax rate for states that have income tax although other states are. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately.

Corporate Income Tax Division. But if legislators take no action the tax rate will remain at 4. No cities within Mississippi charge any additional municipal income taxes so its pretty simple to calculate this part of your employees withholding.

Tax rate of 0 on the first 5000 of taxable income. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. 0 on the first 2000 of taxable income.

Eligible Charitable Organizations Information. Tax rate of 4 on taxable income between 5001 and 10000. Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent.

Mississippi Tax Brackets for Tax Year 2021. There are just three income tax brackets and the tax rates range from 0 to 5. Tate Reeves on Tuesday signed a bill that will reduce the state income tax over four years beginning in 2023.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. See what makes us different. This tool compares the tax brackets for single individuals in each state.

For context even with the individual income tax intact Mississippis state and local revenue per capita is the 4th lowest in the nation. When the plan is fully phased in Gunn said Mississippi will have the 5 th lowest marginal rate of the 41 states with a personal income tax. This is the rate collected across the state with one exception.

The tax brackets are the same for all filing statuses. Gunn said he anticipates the governor will sign the legislation and like him continue to work to eliminate the income tax. The graduated income tax rate is.

Your average tax rate is 1198 and your marginal tax rate is 22. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. Tax rate of 0 on the first 5000 of taxable income.

There is an additional 1 tax in Jackson the state capital. The state sales tax rate in Mississippi is 7. 2021 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

As you can see your income in Mississippi is taxed at different rates within the given tax brackets. Detailed Mississippi state income tax rates and brackets are available on this page. The Mississippi State Tax Tables below are a snapshot of the tax rates and thresholds in Mississippi they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates laws and allowances please see the Mississippi Department of Revenue website.

Mississippi one of the poorest states in the nation has struggling rural hospitals and perpetually underfunded schools. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. Wealthy people would see the biggest financial boost from eliminating the income tax because theyre the ones paying the most now.

The 5 tax on remaining income will drop to 47 for 2023 then 44 for 2025 and 4 starting in 2026. Other things to know about Mississippi state taxes The state also collects taxes on cigarettes and. 3 on the next 3000 of taxable income.

The individual income tax brings in more than 18 billion or 325 percent of General Fund dollars. Each marginal rate only applies to earnings within the applicable marginal tax bracket. For an in-depth comparison try using our federal and state income tax calculator.

This marginal tax rate means that. Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by April 17 2023. These income tax brackets and rates apply to Mississippi taxable income earned January 1 2022 through December 31 2022.

California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those with income of 1 million or more which makes its highest actual tax rate 133. Ad Compare Your 2022 Tax Bracket vs. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent.

Each states tax code is a multifaceted system with many moving parts and Mississippi is no exception. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Mississippi State Personal Income Tax Rates and Thresholds in.

Corporate and Partnership Income Tax Help. These rates are the same for individuals and businesses. Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent.

However prescription drugs are exempt from the sales tax in Mississippi. For income taxes in all fifty states see the income tax by state. Tax rate of 5 on taxable income over 10000.

5 on all taxable income over 10000. Employees who earn more than 10000 a year will hit the top bracket. 4 on the next 5000 of taxable income.

For single taxpayers living and working in the state of Mississippi. For married taxpayers living and working in the state of Mississippi.

Individual Income Tax Structures In Selected States The Civic Federation

The Most And Least Tax Friendly Us States

Mississippi Tax Rate H R Block

Historical Mississippi Tax Policy Information Ballotpedia

Strengthening Mississippi S Income Tax Hope Policy Institute

Mississippi Sales Tax Small Business Guide Truic

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Rate H R Block

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

State Corporate Income Tax Rates And Brackets Tax Foundation

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

As More Americans Move To No Income Tax States More Lawmakers Move To Phase Out State Income Taxes

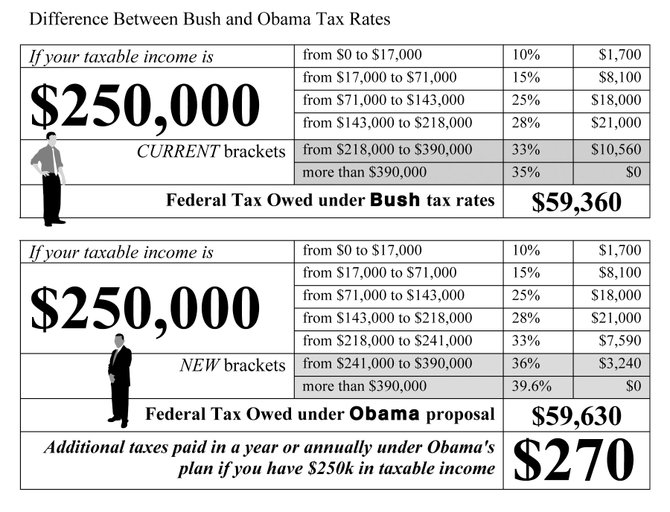

Taxes Obama Vs Bush Rates Jackson Free Press Jackson Ms

States With Highest And Lowest Sales Tax Rates

Tax Rates Exemptions Deductions Dor

State Corporate Income Tax Rates And Brackets Tax Foundation