are hoa fees tax deductible in nj

A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood. Though many costs of owning a home are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are considered an assessment by a private entity.

How To Claim Closing Cost Deduction On Income Tax Return

Personal Property Tax Relief PPTR Calculator.

. However the new law only allows. If your annual HOA fees are 1000 approximately 667 would be deductible on your tax return. Claim form veterans or surviving spouses VSS.

There may be exceptions however if you rent the home or have a home office. Under the new tax law for 2018 you can deduct up to 10000 in state and property taxes. But there are some exceptions.

You can reach HOA fees tax deductible status if you rent out your property either year-round or for a specific portion of the year. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense. If you live in your property year-round then the HOA fees are not deductible.

While the interest paid on home loans is tax deductible the fees paid to these. While HOA fees arent tax deductible for your primary residence there are other expenses that are deductible. The short answer is no HOA fees are not tax deductible.

Are hoa fees tax deductible in nj Tuesday March 8 2022 Edit. Expenses include mortgage interest as well as many other things like property taxes insurance HOA dues if its a condo maintenance fees rental management. Therefore if you use the home exclusively as a rental property you.

However you might not be able to deduct an HOA fee that covers a special assessment for improvements. It depends but usually no. The answer regarding whether or not your HOA fees are tax deductible varies depending on the situation.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. Generally HOA dues are not tax deductible if you use your property as a home year-round. This rule also applies if you only have a small office in your home.

If the home is a rental property then you can deduct the HOA. Check cashing not available in NJ NY RI VT and WY. There are many costs with homeownership that are tax-deductible such as your mortgage interest and property taxes however the IRS will not permit you to deduct HOA fees they are considered a charge by a private individual.

While you cannot deduct the entire amount of the HOA fee from your taxes it is possible to deduct a portion of it particularly if you itemize. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600. Any HOA that has sizable non-exempt function income may find that they pay.

Similarly you can reach homeowner. Additionally if you use the home as your primary residence your HOA fee wont be tax deductible unless you work from home or run a. Are HOA Fees Tax Deductible.

State of New Jersey website. Under section 528 HOAs are allowed to have non-exempt function income. Its not enough to be able to afford the mortgage payment on a given house you have to pay your HOA fees so.

The previous limit was 1 million and that amount still holds true. Are Hoa Fees Tax Deductible Clark Simson Miller Youll need a distinctive font and logo. State of New Jersey website.

You may be wondering whether this fee is tax deductible. If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas. Homeowners associations are allowed a 100 deduction on taxable income and a flat rate of 30 applied.

If approved you could be eligible for a credit limit between 350 and. When youre house hunting be sure to learn what the monthly fees are for any HOA communities youre considering. An election to file Form 1120 H is done annually before its due date which is the 15 th day of the third month after a tax year.

A monthly HOA fee could be less than 100 or more than 1000. For first-time homebuyers your HOA fees are almost never tax deductible. For instance if you use 10 of your home as.

However if you have an office in your home that you use in connection with a trade or business then you may be able to deduct a portion of the HOA fees that relate to that office. The short answer is. Tax Tips for New Jersey HOAs and Condo Associations.

You can also deduct mortgage interest up to 750000 if it is a new loan. It does this with the help of hoa dues fees that the association collects from members. Among the tax deductions for homeowners selling their homes in new jersey are property state or local income taxes or sales tax limited to a total deduction of 10000 for married couples filing jointly.

It is important to remember that according to 2018s Tax Cuts and Jobs Act this deduction is only allowable for those who are self-employed. But the profit is taxed at the 30 rate as compared to the corporate tax that starts at 15. The IRS considers HOA fees as a rental expense which means you can write them off from your taxes.

Unfortunately homeowners association HOA fees paid on your personal residence are not deductible. To revoke an election requires the consent of IRS. A few common circumstances.

In general homeowners association HOA fees arent deductible on your federal tax return. Are homeowners association fees tax deductible. Year-round residency in your property means HOA fees are not deductible.

Typically theyll be 200 300 per month. Are hoa fees tax deductible in nj Tuesday March 8 2022 Edit. Any percentage used in conjunction with this business or office may be tax-deductible.

It does this with the help of HOA dues fees that the association collects from members. 2 days agoMonroe Manor Inn 02. Are hoa fees tax deductible in nj Tuesday March 15 2022 Edit.

As a general rule hoa fees are not deductible. This is an annual deduction from taxes due in the amount of 250 to qualified veterans or their surviving spouse. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities.

These fees are used to fund the associations maintenance and operations. However if the home is a rental property HOA. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood.

You can also deduct 10 of your HOA fees. Additionally an HOA capital improvement assessment could increase the cost basis of your home which could have several tax consequences. 6 to 30 characters long.

To pay with zelle send payment to.

New Jersey Hoa Laws Rules Resources Information Homeowners Protection Bureau Llc

Tax Tips For Homeowners Nj Lenders Corp

New Jersey Hoa Condo Association Tax Return Filing The Concise Guide

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible Experian

Are Hoa Fees Tax Deductible Clark Simson Miller

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Rental Property Deductions 21 Tax Deductions For Landlords In 2022

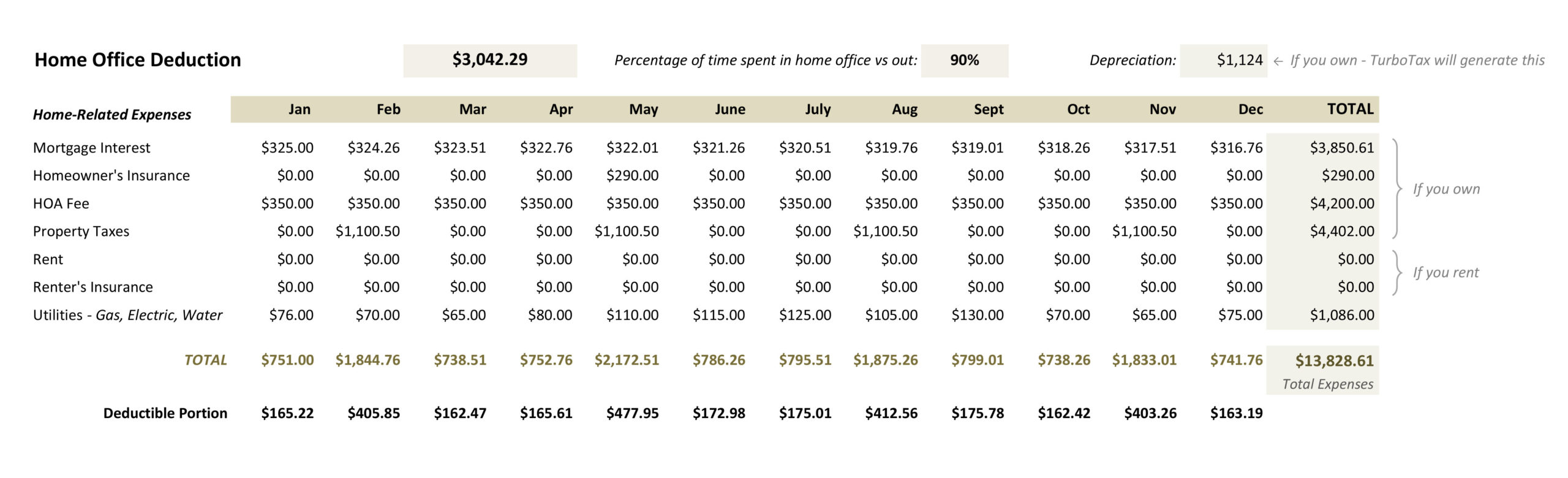

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

10 Crestmont Rd Apt 1e Montclair Nj 07042 Realtor Com

10 Crestmont Rd 1e Montclair Nj 07042 Mls 21041695 Coldwell Banker

Is Car Insurance Tax Deductible H R Block

What Hoa Costs Are Tax Deductible Aps Management

Are Hoa Fees Tax Deductible Clark Simson Miller

What Happens If You Don T Pay Hoa Fees Cmg